Customer Loyalty Checkup: How Does Your NPS Score Measure Up?

Measuring Net Promoter Score (NPS) is like having a compass for customer loyalty. It not only points you in the right direction for growth but also highlights areas where you need to improve to turn your customers into enthusiastic promoters.

Ever wonder if your customers would recommend you to their friends? Sure, social media likes and positive reviews are great, but what if there was a single metric that captured the true essence of customer loyalty? Enter the Net Promoter Score (NPS) – your secret weapon for gauging customer sentiment and identifying areas for improvement.

In this blog, we’ll crack open the NPS vault and answer all your burning questions:

So, grab a cup of coffee (or your beverage of choice!), settle in, and get ready to unlock the secrets of customer loyalty!

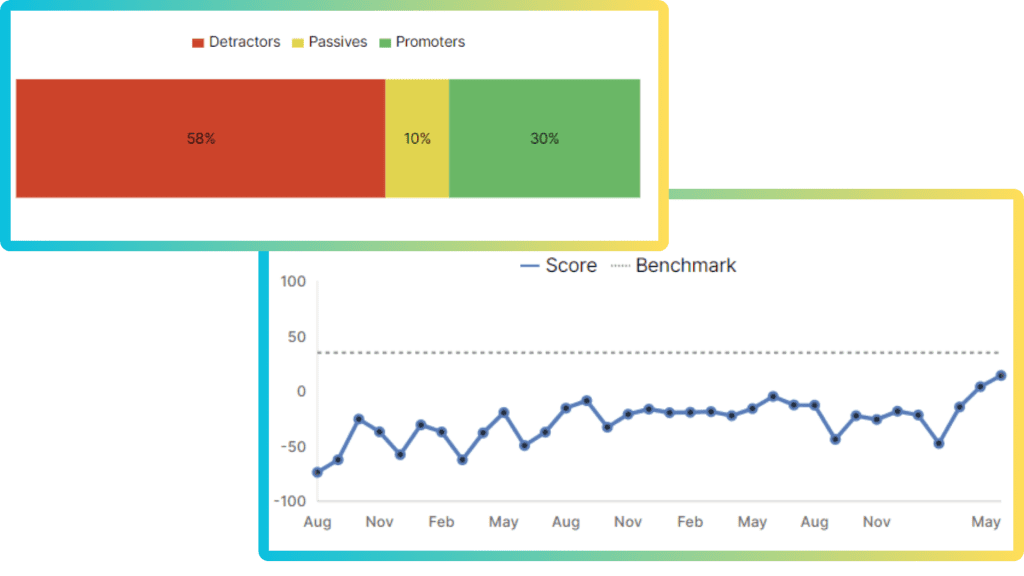

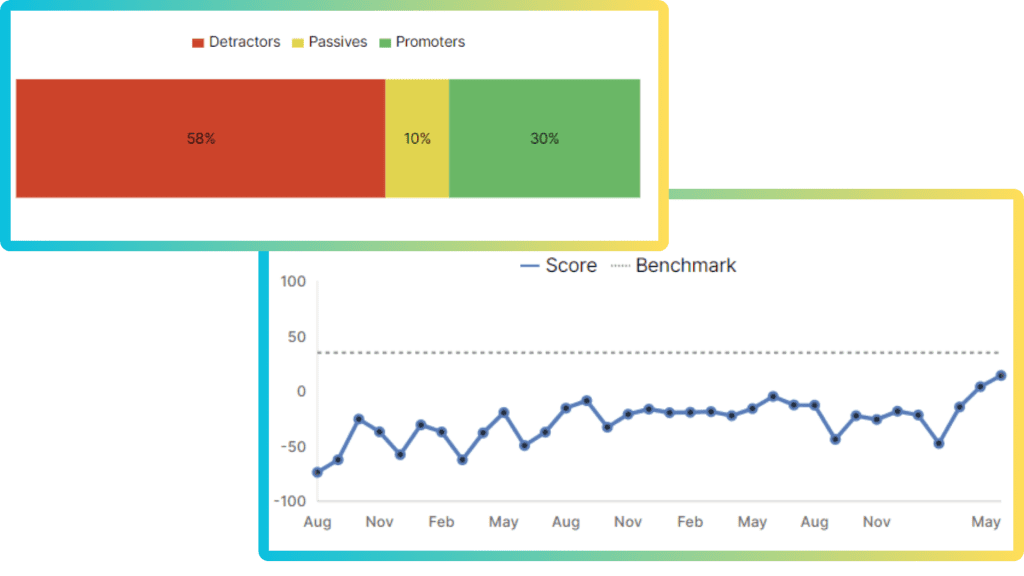

Net Promoter Score (NPS) is a simple yet powerful metric that gauges customer loyalty. It’s based on a single question: “On a scale of 0-10, how likely are you to recommend our product/service to a friend or colleague?” Based on their responses, customers are categorized into three groups:

Loyal enthusiasts who will keep buying and refer others, fueling growth.

Satisfied but unenthusiastic customers who are vulnerable to competitive offerings.

Unhappy customers who can damage your brand through negative word-of-mouth.

To calculate NPS, subtract the percentage of Detractors from the percentage of Promoters. The score can range from -100 to +100.

So, a score of +50 means you have 50% more promoters than detractors – a fantastic indicator of customer loyalty!

Benchmarking your NPS helps you understand how your customer loyalty compares to industry standards. This comparison provides context and sets a baseline for evaluating your performance. Knowing the average NPS in your industry can help you gauge whether your score is competitive or if there’s room for improvement.

By comparing your NPS with those of similar businesses, you can pinpoint your strengths and weaknesses. If your NPS is lower than the industry average, it signals that you need to investigate and address underlying issues. Conversely, if your NPS is higher, you can identify the practices and strategies that are contributing to your success and continue to refine them.

Benchmarking allows you to set realistic and achievable goals for your customer loyalty initiatives. It provides a clear target based on industry performance, making it easier to track progress and measure the effectiveness of your efforts. This targeted approach helps in resource allocation and strategic planning.

Understanding where you stand in relation to your competitors is crucial for maintaining and enhancing your competitive edge. Benchmarking your NPS helps you identify areas where you can outperform competitors and leverage your strengths to attract and retain more customers. It also highlights areas where you need to improve to stay competitive.

Benchmarking fosters a culture of continuous improvement. Regularly comparing your NPS against industry standards encourages ongoing evaluation and optimization of your customer experience strategies. This proactive approach ensures that you are always striving to enhance customer satisfaction and loyalty.

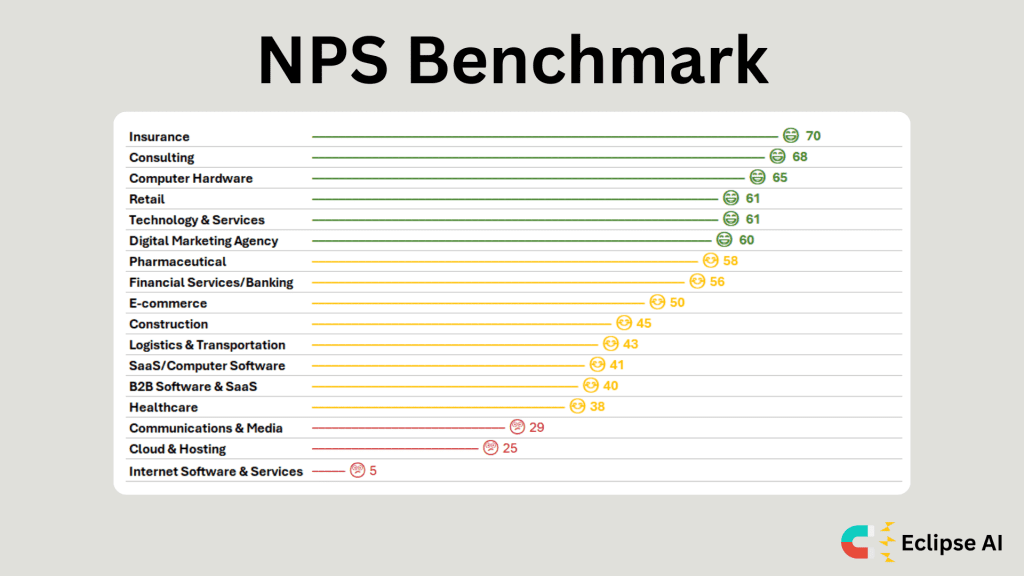

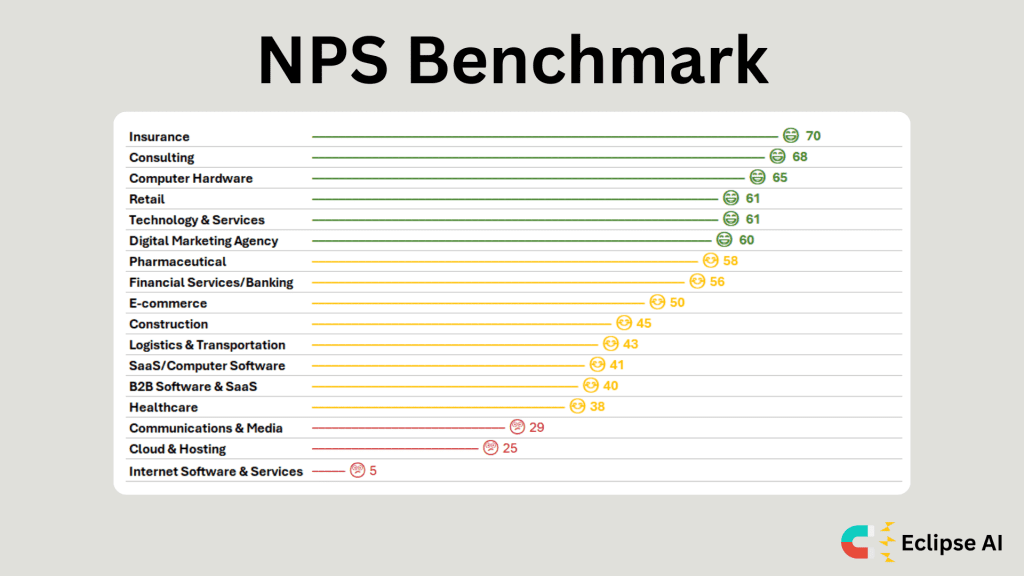

Here’s a quick rundown of average scores across different sectors (remember, these are averages, and your specific score may vary):

Generally higher NPS scores, ranging from +39 to +76

Scores tend to be lower, averaging between +16 and +80

Retail companies tend to have higher NPS scores due to their focus on delivering exceptional customer experiences, personalized services, and effective loyalty programs that keep customers engaged and satisfied.

E-commerce platforms score slightly lower on average, as they face more competition and need to continuously innovate to meet evolving customer expectations around convenience, selection, and delivery.

Insurance companies have higher NPS scores due to their long-standing reputation for reliability and trustworthiness, which instills confidence in customers.

Banking and other financial services tend to score lower on average, as they often struggle with providing consistently good customer service and effective communication with clients.

Technology and software companies score moderately well on average, as they are able to leverage innovative products and services to meet customer needs.

Computer hardware companies score higher, as they can focus on delivering high-quality, reliable products backed by excellent customer support.

Healthcare companies tend to have lower NPS scores due to factors like long wait times, complex billing, and lack of transparency, which can frustrate patients and negatively impact the overall experience.

Pharmaceutical companies score better on average, as they are able to focus on research, development, and delivering effective treatments that improve people’s lives.

Ready to turn those passives into promoters and watch your NPS soar? Here are some actionable tips:

1. Make NPS Measurement a Habit

Regularly collect NPS data to track progress and identify trends.

2. Listen to Your Feedback

Analyze customer comments to understand what drives promoters and detractors.

3. Respond to All Feedback

Both positive and negative feedback shows you care and helps identify areas for improvement.

By consistently measuring NPS, listening to feedback, and taking action to improve, you can transform passives into promoters and watch your customer loyalty (and your business!) flourish. Remember, the NPS journey is a continuous process. Keep striving to provide exceptional customer experiences, and watch your score climb steadily towards promoter paradise!

Net Promoter®, NPS®, NPS Prism®, and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., NICE Systems, Inc., and Fred Reichheld. Net Promoter ScoreSM and Net Promoter SystemSM are service marks of Bain & Company, Inc., NICE Systems, Inc., and Fred Reichheld.

Start Measuring Your Brand’s NPS

Don’t Let Your Competitors Understand Your Customers Better Than You

Don’t miss out. Try our 30-day Free Professional Trial.